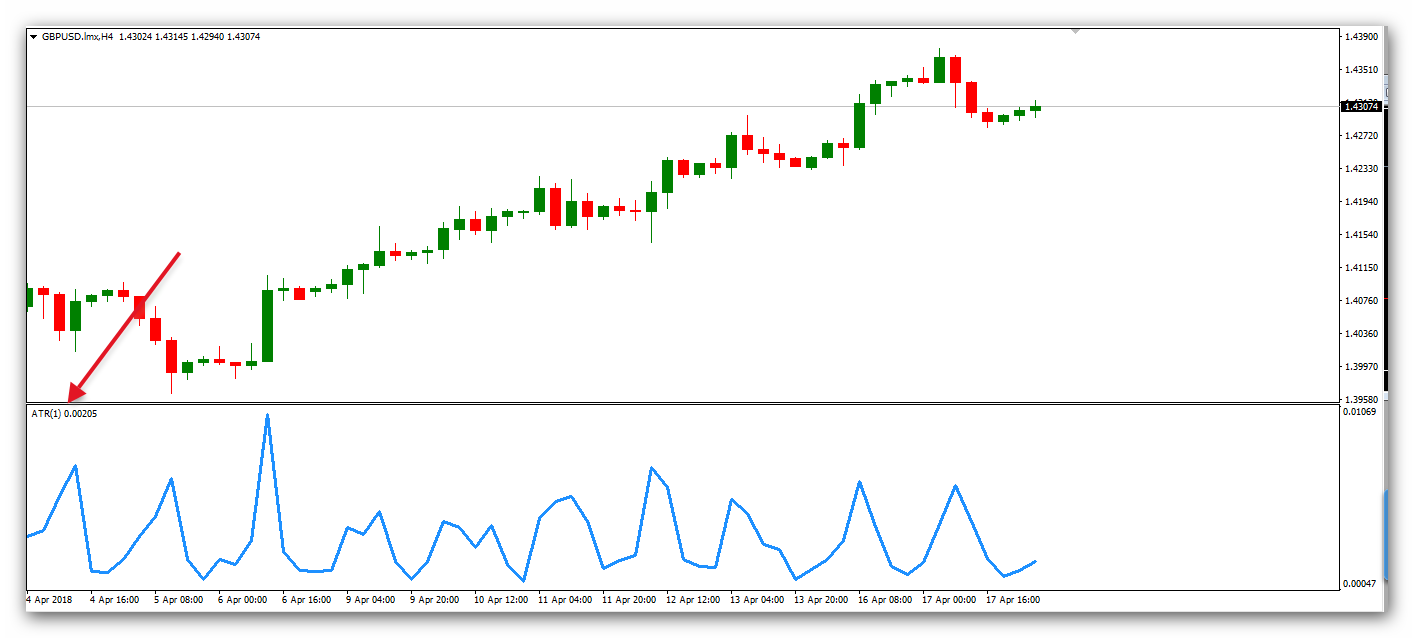

6/10/ · The ATR indicator was originally designed with commodities in mind, but today it is widely applied to both the stock and Forex market. The 'Turtles' mentioned above, for example, traded a cross-section of bond, commodity, and Forex futures, and used the ATR indicator as their position-sizing tool for all 4/29/ · The average true range (ATR) is a market volatility indicator used in technical analysis. It is typically derived from the day simple moving average of a series of true range indicators. The ATR 10/30/ · Jika indikator Average True Range (ATR) ini secara konstan memperlihatkan nilai yang rendah, biasanya pasar berada dalam keadaan yang sideway. Namun apabila indikator ATR ini justru memperlihatkan kenaikan yang signifikan, maka bisa jadi itu merupakan pertanda bahwa volatilitas (kemungkinan) akan semakin tinggi. Strategi forex & manajemen risiko

Mengenal Penggunaan Indikator Forex Average True Range (ATR)

Developed by J. Welles Wilder, the Average True Range ATR is an indicator that measures volatility. As with most of his indicators, Wilder designed ATR with commodities and daily prices in indikator atr. Commodities are frequently more volatile than stocks.

They indikator atr are often subject to gaps and limit moves, which occur when a commodity opens up or down its maximum allowed move for the session. A volatility formula based only on the high-low range would fail to capture volatility from gap or limit moves.

It is important to remember that ATR does not provide an indication of price direction, just volatility. Wilder features ATR in his book, New Concepts in Technical Trading Systems, indikator atr. This book also includes the Parabolic SAR, RSI and the Directional Movement Concept ADX, indikator atr.

Despite being developed before the computer age, Wilder's indikator atr have stood the test of time and remain extremely popular. Wilder started with a concept called True Range TRwhich is defined as the greatest of the following:. Absolute values are used to ensure positive numbers.

After all, Wilder was interested in measuring the distance between two points, indikator atr, not the direction. If the current period's high is above the prior period's high and the low is below the prior period's low, then the current period's high-low range will be used as the True Range. This is an outside day that would use Method 1 to calculate the TR. This indikator atr pretty straightforward. Methods 2 and 3 are used when there is a gap or an inside day, indikator atr.

A gap occurs when the previous close is greater than the current high signaling a potential gap down or limit move or the previous close is lower than the current low signaling a potential gap up or limit move.

The image below shows examples of when methods 2 and 3 are appropriate. The TR equals the absolute value of the difference between the current high and the previous close. The TR equals the absolute value of the difference between the current low and the previous close. In fact, indikator atr, it is smaller than the absolute value of indikator atr difference between the current high and the previous close, which is used to value the TR. Typically, the Average True Range ATR is based on 14 periods and can be calculated on an intraday, daily, weekly or monthly basis.

For this example, the ATR will be based on daily data. Because there must be a beginning, the first TR value is simply the High minus the Low, and the first day ATR is the average of the daily TR values for the last indikator atr days. After that, Wilder sought to smooth the data by incorporating the previous period's ATR value.

Click here for an Excel Spreadsheet showing the start of an ATR calculation for QQQ. In the spreadsheet example, the first True Range value. The first day ATR value. Subsequent ATR values were smoothed using the formula above. The spreadsheet values correspond with the yellow area on the chart below; notice how ATR surged as QQQ plunged in May with many long candlesticks. For those trying this at home, a few indikator atr apply. First, just like with Exponential Moving Averages EMAsATR values depend on how far back you begin your calculations, indikator atr.

The first True Range value is simply the current High minus the current Low and the first ATR is an average of the first 14 True Range values. The real ATR formula does not kick in until day Spreadsheet values for a small subset of data may not match exactly with what is seen on the price chart. Decimal rounding can also slightly affect ATR values. On our charts, we indikator atr back at least periods typically much furtherto ensure a much greater degree of accuracy for our ATR values, indikator atr.

ATR is based on the True Range, which uses absolute price changes. As such, ATR reflects volatility as absolute level. In other words, ATR is not shown as a percentage of the current close. This means low-priced stocks will have lower ATR values than high price stocks. Because of this, ATR values are not comparable. Even large price movements for a single security, such as a decline from 70 to 20, can make long-term ATR comparisons impractical.

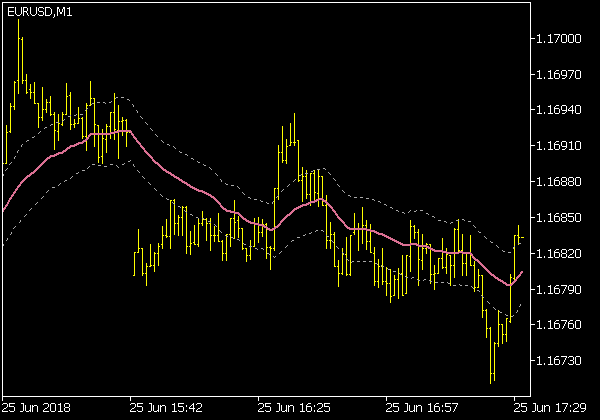

Chart 4 shows Google with double-digit ATR values and chart 5 shows Microsoft with ATR values below 1. Despite different values, their ATR lines have similar shapes. ATR is not a directional indicator like MACD or RSI, but rather a unique volatility indicator that reflects the degree of interest or disinterest in a move.

Strong moves, in either direction, are often accompanied by large ranges, or large True Ranges. This is especially true at the beginning of a move, indikator atr. Uninspiring moves can be accompanied by relatively narrow ranges. As such, ATR can be used to validate the enthusiasm behind a move or breakout. A bullish reversal with an increase in ATR would show strong buying pressure and reinforce the reversal. A bearish indikator atr break with an increase in ATR would show strong selling pressure and reinforce the support break.

To adjust indikator atr period setting, indikator atr, highlight the indikator atr value and enter a new setting. In his work, Wilder often used an 8-period ATR. SharpCharts also allows users to position the indicator above, indikator atr, below or behind the price plot. A moving average can be added to identify upturns or downturns in ATR.

Click here for a live example of ATR. The Average True Range indicator can be used in scans to weed out securities with extremely high volatility. The final scan clause excludes high volatility stocks from the results. Note that the ATR is converted to a percentage of sorts so that the ATR of different stocks can be compared on the same scale. For more details on the syntax to use for ATR scans, please see our Scanning Indicator Reference in the Support Center.

Which Volatility Measure? In order to use StockCharts. com successfully, you must enable Indikator atr in your browser. Click Here to learn how to enable JavaScript.

Average True Range ATR. You are here: ChartSchool » Technical Indicators and Overlays » Average True Range ATR, indikator atr. Table of Contents Average True Range ATR. Wilder started with a concept called True Range TRwhich is defined as the greatest of the following: Method 1: Current High less the current Low. Attention: your browser does not have JavaScript enabled!

Fungsi Indikator ATR dalam Trading Saham \u0026 Forex

, time: 6:21Average True Range Indicator Overview – What is ATR? | CFI LB

Trade ATR at AvaTrade The Average True Range (ATR) is a common technical analysis indicator designed to measure volatility. This indicator was originally developed by the famed commodity trader, developer and analyst, Welles Wilder, and it was introduced in Estimated Reading Time: 9 mins 9/3/ · The ATR indicator is a volatility indicator that measures how much the price of an asset has been moving over some time, and how volatile the asset has been 10/30/ · Jika indikator Average True Range (ATR) ini secara konstan memperlihatkan nilai yang rendah, biasanya pasar berada dalam keadaan yang sideway. Namun apabila indikator ATR ini justru memperlihatkan kenaikan yang signifikan, maka bisa jadi itu merupakan pertanda bahwa volatilitas (kemungkinan) akan semakin tinggi. Strategi forex & manajemen risiko

No comments:

Post a Comment